r&d tax credit calculation example uk

100000 130 130000. 100000 X 130 130000.

R D Tax Credit Calculation Methods Adp

Select whether the company is profitable or loss making.

. The next step takes the current year expenditures of 95000 and subtracts the 40000 three-year average for a net of 55000. Bolton BL1 4QZ 0161 298 1010. To find out more RD Tax Credit Project Examples for your industry or to learn more about what the RD Tax Credits scheme can do for you contact our team of RD Tax Credits specialists today.

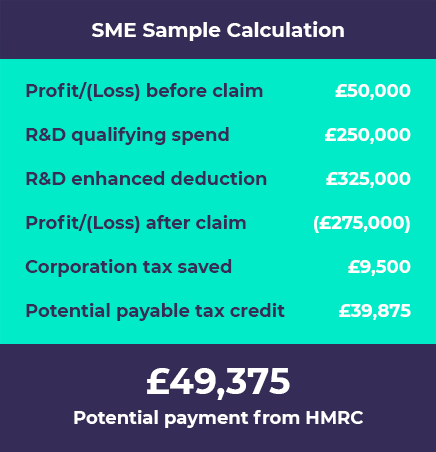

Company X made profits of 400000 for the year calculate the RD tax credit saving. Corporation Tax prior to RD Tax Credits Claim. Deduct the RD enhanced expenditure within the tax computation.

The 32500 is therefore the qualifying amount added to other eligible costs. Free RD Tax Calculator. If there is a 100000 payment to a subcontractor of which half is for RD activities the calculation would be 100000 x 50 50000 x 65 32500.

Nowhere else will you find funding for the. The notional additional 130 RD tax deduction is deducted within the company tax computation. The qualifying expenditure is 100000 thats already in accounts as expenditure.

76000 - 51300 24700 approximately 25 2. The RD Tax Relief for UK small and medium-sized enterprises SMEs has the same calculation for all companies applying to the program but your companies corporation tax has an effect on the return. Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief.

The next step is easy. So our simplified example tax computation would show. Menu Title for Footer Menu Links 1.

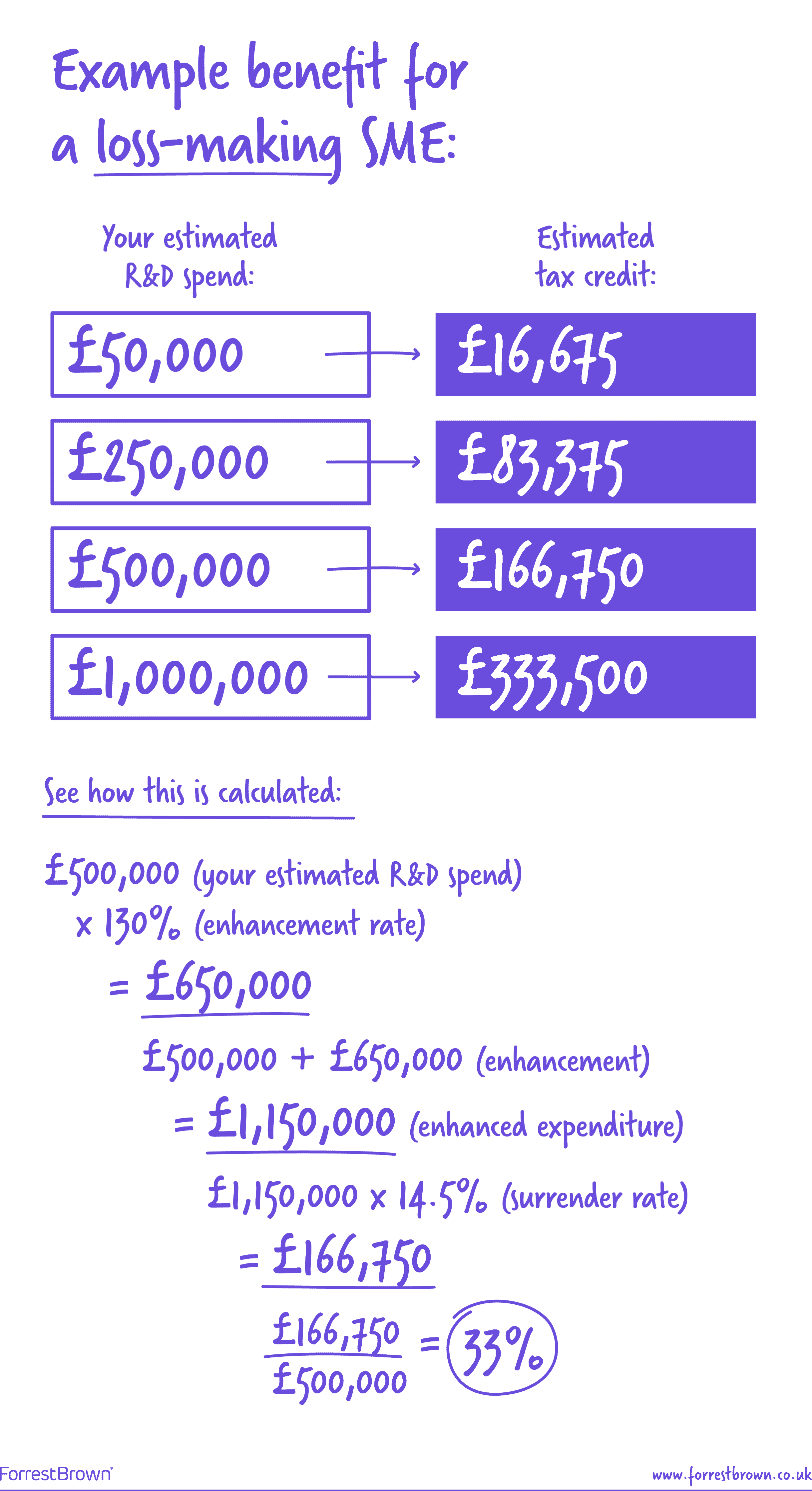

Below we have outlined three scenarios with the same RD expenditures but the difference is a company in a loss position breakeven and profit. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount. 100000 x 130 enhanced rate 130000.

Large Regime RDEC. You take 50 or half of this amount which is 40000. The financial benefit to making a RD tax relief claim can be extremely significant.

For accounting periods beginning on or after 1 April 2021 the payable RD tax credit that a loss-making SME can receive will be capped at 20000 plus three times the amount paid in respect of PAYE and Class 1 NIC liabilities. Say our example SME made a loss of 300000 for the year with the same 100000 RD QE and chose to surrender losses and claim relief. 100000 x 230 230000 uplifted qualifying expenditureRD tax losses 230000 x 145 33350 saving or refund.

Calculate how much RD tax relief your business could claim back. Calculate RD tax relief in under 3 minutes. 130000 x 19 corporation tax rate 24700.

250k less costs of 120k. Average calculated RD claim is 56000. Claiming RD tax relief can be a complex process.

The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable as trading income. 12 from 1 January 2018 to 31 March 2020. The cap therefore does not apply for companies whose payable credits is not more than 20000.

Officerndtaxcouk 181 Chorley New Rd. Below are the various examples of how a claim value is calculated. Enhanced RD qualifying spend or uplift.

Select either an SME or Large company. In the final step the business owner will calculate the ASC by multiplying 55000 by 14 for a final credit of 7700. RD Tax Credit Calculation Examples.

Just follow the simple steps below. Loss after deduction of profit. Before RD tax additional deduction.

It was increased to. 300000 130000 430000 Maximum Losses to surrender. The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017.

100000 x 230 230000. The corporation tax saving. Kene Partners can help you claim.

The company can now either carry the loss forwards to be offset against taxable points or the. Home RD Tax Credits Calculator. Guidance on this can be found on our Which RD scheme is right for my company page.

Taxable profit before RD. The article contains simplified examples for purposes of. First however the fix-based percentage must be obtained by dividing the QREs for tax years during a base period by the gross receipts from the same period.

The calculation of your RD tax relief benefit depends on the companys situation whether it falls into the category of-. SME Scheme calculation for a company that was profitable and spent 100000 on qualifying RD activities in a given year.

Research Development Tax Credits Guide Ebs European Business Solutions

R D Tax Credit Calculation Examples Mpa

R D Tax Credits The Essential Guide 2020

Doing Business In The United States Federal Tax Issues Pwc

R D Tax Credit Rates For Rdec Scheme Forrestbrown

R D Tax Credit Calculation Methods Adp

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

R D Tax Credit Rates For Rdec Scheme Forrestbrown

How Far Back Can You Claim R D Tax Relief

Rdec Scheme R D Expenditure Credit Explained

How Is R D Tax Relief Calculated Guides Gateley

R D Tax Credit Rates For Sme Scheme Forrestbrown

Sjcomeup Com R D Uk Tax Calculator

.png)

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

R D Tax Credits Calculation Examples G2 Innovation

Rdec 7 Steps R D Tax Solutions

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible